ACA Update | November 17, 2017 – Tax and Health Care Repeal Bill Passes House, Focus Shifts to Upcoming Senate Vote

Last week, we learned the House version of the tax bill would eliminate the medical expense deduction. This deduction is a lifeline for cancer patients who claim it, as cancer care and the enormous out-of-pocket costs associated with it often result in financial toxicity and financial distress. As the LA Times reports, “What’s cruelest about the effort to repeal the medical expense deduction is that it directly targets some of the most vulnerable Americans. They’re people who already are shouldering catastrophic medical expenses, with only the deduction standing between them and poverty.” While the House wanted the deduction gone, the Senate version of the tax bill keeps this critical deduction. If the bills pass, the two chambers will negotiate during conference and in the meantime, NCCS is actively working to ensure the medical expense deduction is not eliminated.

But the tax bill gets worse for cancer patients and survivors. The Senate Finance Committee included the repeal of the individual mandate this week. Throughout the year, NCCS has stressed the importance of the mandate as it is the lynchpin for patient protections. An insurance system without patient protections would be devastating for cancer patients who rely on access to quality and affordable health care. The Congressional Budget Office (CBO) estimates that if the individual mandate is repealed, 13 million Americans would be left without health coverage and premiums would rise by 10%. But Congressional Republicans are looking for ways to offset tax cuts and taking health care away from 13 million people would save more than $300 billion.

“The individual mandate is a central tenet of Obamacare that health policy experts and proponents say is essential to making the law work. It compels young and healthy people to join health insurance markets and help lower premiums by offsetting the costs of sicker patients,” reports Business Insider. NCCS is also concerned that passage of tax legislation that increases deficits by $1.5 trillion would trigger sequestration. This means that cuts of $25 billion in 2018 to Medicare would be automatic and would hurt cancer patients who rely on Medicare.

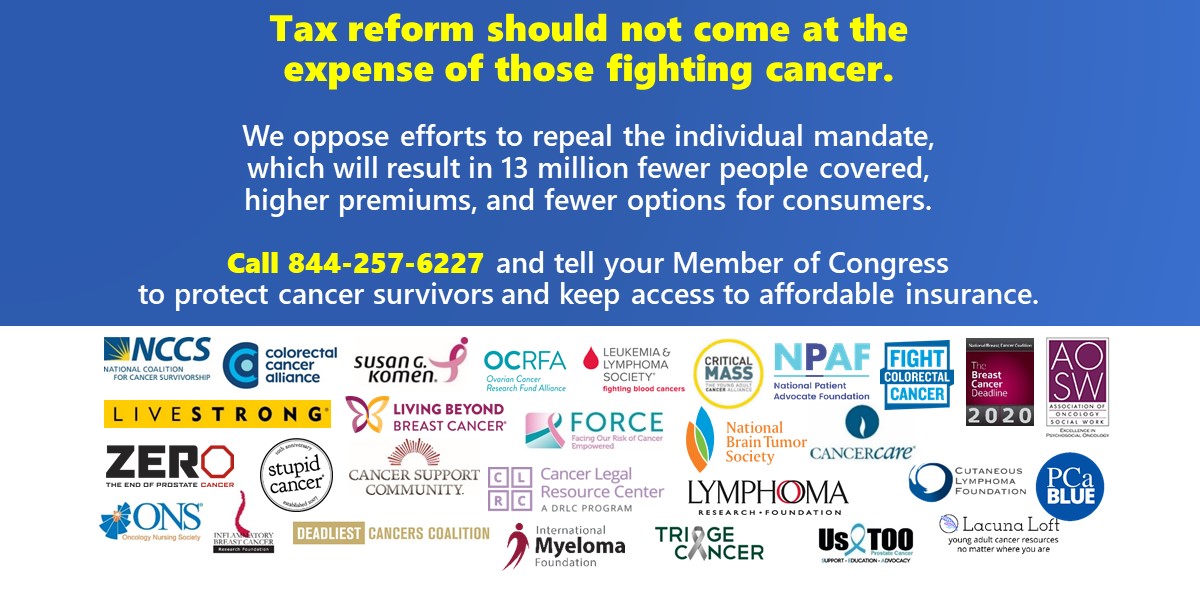

Tax reform should not come at the expense of those living with cancer. NCCS joined 29 organizations in a campaign to oppose the repeal of the individual mandate and protect cancer patients’ access to quality and affordable health care. This legislation is moving quickly, so Congress needs to hear from you NOW.

The House voted Thursday afternoon to pass its bill, and the Senate is scheduled to vote soon after Thanksgiving break. Call your Senators today using our hotline at (844) 257-6227 and ask them to stand up for cancer patients by opposing the individual mandate repeal in the tax legislation.

For more information on how you can get involved, check out our #ProtectOurCare page »

Follow NCCS on Twitter to stay updated on developments: @CancerAdvocacy.