as a Cancer Survivor

Choosing the right health insurance plan can be a difficult process, especially for those with complex health care needs. Open enrollment is your opportunity to enroll in or make changes to your health insurance plan.

Assessing Your Needs as a Cancer Survivor

Cancer survivors may have significant cancer care needs that will influence their insurance coverage requirements. A survivor in active treatment may need to consider whether their insurance plan covers the cancer care specialists they are relying on and has affordable and adequate coverage of the drugs that are part of their treatment plan, for example. Survivors thriving after active treatment also have specific follow-up care and monitoring needs. Cancer survivors need to understand their rights and responsibilities under their insurance plans as well.

NCCS, through this multi-media educational effort, hopes to help cancer survivors define their care needs and evaluate their insurance plan options for coverage and payment of their care. On this page, experts provide guidance on how to assess the adequacy of available insurance options for cancer care coverage, according to a cancer survivor’s treatment and survivorship plans.

Open Enrollment Webinar: Choosing Health Coverage As a Cancer Survivor

Open enrollment is your opportunity to enroll in or make changes to your health insurance plan. In this webinar, we discuss what cancer survivors should consider in assessing their insurance coverage so you can select the best plan for you.

Topics covered include:

- Understanding cost-sharing and out-of-pocket spending.

- Determining whether and how prescription drugs are covered.

- Understanding in-network and out-of-network coverage.

- Anticipating how care needs evolve during treatment and the transition to post-treatment care.

Video Chapters

- 00:00 Introduction

- 02:40 Ana María López – The Complexities of Health Coverage

- 08:42 Tricia Neuman – Medicare Open Enrollment Overview

- 15:08 Karen Pollitz – Employer-Based Insurance, Healthcare.gov, and Medicaid

- 32:25 Medicaid Advantage & Cancer Survivors

- 40:22 Prior Authorization Concerns In Medicare

- 44:10 Medicare Part D Prescription Coverage

- 47:45 Part D Cancer Drug Coverage & Copay Assistance

- 50:46 How should survivors change coverage as they transition from treatment?

- 56:41 Choosing a Medigap Plan

Featured Speakers:

Ana María López, MD, MPH

Vice Chair, Medical Oncology

Sidney Kimmel Cancer Center

Tricia Neuman, ScD

Senior Vice President

KFF

Karen Pollitz, MPP

Health Insurance Expert & Cancer Survivor

Choosing the Right Plan – Mila Kofman

Each of us has a different need in different financial circumstances. The least expensive plans have lower premiums but higher out-of-pocket costs like annual deductibles, and in many cases, higher co-payments, higher co-insurance. It really depends on your financial situation, what plan is best for you… If you have very expensive medical conditions, if you’re undergoing chemotherapy, for example, you may want a plan that has no deductible and very low out-of-pocket costs, but your premiums will be higher.

HMO or PPO? – Kaye Pestaina

An HMO is generally a single set of providers under one roof. If you sign up for that HMO, your choice of providers is limited just to those who are under that umbrella of coverage, whether that’s a primary care or a specialist, and you typically will have to have a primary care physician in order to get to see a specialist. A PPO is different. You have a broader set of providers. You’ll have more variety, but they may not necessarily be coordinating with one another. You could go to a specialist without having to get a referral from a primary care physician.

Handling Issues and Questions About Your Plan

After you have enrolled in a health insurance plan, you may encounter issues with claims and pre-authorization requirements, or you may have questions about your insurance plan and its benefits. For some, assistance can be obtained through Consumer Assistance Programs: Consumer Assistance Program | CMS.

Unfortunately, CAPs are not available in all states. But for consumers in states with CAPs, you should not hesitate to use the CAP resources.

Medicare Beneficiaries

When is Open Enrollment for Medicare?

October 15 to December 7, 2024 (For traditional Medicare, Medicare Advantage, Medigap, and Medicare Part D prescription drug benefit)

Options for action to choose a plan for 2025:

- Go to Medicare.gov to explore your Medicare coverage options. You can review coverage options by signing into your Medicare account or without logging in.

- Call Medicare at 1-800-MEDICARE during Open Enrollment.

- Contact your local STATE HEALTH INSURANCE ASSISTANCE PROGRAM (SHIP). Visit shiphelp.org to get the phone number for your state.

The Medicare Team offers this important advice:

NOTE: If you make less than $22,591 a year ($30,661 for married couples), it’s worth applying for “Extra Help.” Extra Help can pay for your prescription drug coverage (Part D) premiums, deductibles, coinsurance, and other costs. Visit ssa.gov/extrahelp or call Social Security at 1-800-772-1213 to apply for Extra Help.

You will also likely receive information from insurers offering Medicare Advantage plans, including Special Needs Medicare Advantage plans for dual eligibles. You will also see advertisements, including televisions commercials, highlighting Medicare Advantage plans. The brokers from those companies can review plan options, but the resources above, including the SHIP in your state, will be useful to you in evaluating your enrollment options. The NCCS webinar that you may have viewed and that is available online will also help you with evaluating Medicare Advantage options for cancer survivors.

Medicare Part D (Prescription Drug Benefit)

Medicare Part D helps cover the cost of prescription drugs. In 2025, two changes to the Part D program, as a result of the Inflation Reduction Act, will help Medicare beneficiaries save money on prescription drugs. First, there will be a $2,000 cap on out-of-pocket costs for covered drugs. It is important to ensure that your prescriptions are covered under your Part D plan. Once you reach the $2,000 cap, you’ll automatically receive “catastrophic coverage” and won’t have to pay out-of-pocket for covered Part D drugs for the rest of the year. Additionally, the Medicare Prescription Payment Plan is a new voluntary payment option that allows beneficiaries to spread the out-of-pocket prescription costs over the year. To participate, you must opt-in to the program each year.

Read tips for choosing a Part D program (PDF)

Read more about the Medicare Prescription Payment Plan (PDF)

Affordable Care Act (ACA) Marketplace Plans

When is Open Enrollment for Affordable Care Act Marketplace Plans?

- For states using healthcare.gov: November 1, 2024-January 15, 2025

- Enroll by December 15 for coverage that starts January 1

- Enroll by January 15 for coverage that starts February 1

- For states operating their own exchanges: Dates may differ from healthcare.gov, with later end dates for open enrollment.

If you live in a state that uses healthcare.gov as its marketplace, you can use the resources available at that website. You can determine whether your state operates its own exchange or uses healthcare.gov by previewing plan options at this link: https://www.healthcare.gov/see-plans/#/. You will be asked to enter your zip code, and if your state runs its own exchange instead of participating in healthcare.gov, you will be directed to the appropriate website and available resources.

You can apply for ACA marketplace plan coverage in the way that works for you:

- Online

- By phone

- With the help of someone in your community, like a navigator or assister

- Through an agent/ broker

- Through certified enrollment partner websites

- With a paper application

If you are enrolling in an ACA Marketplace plan for the first time, you will want to compare the plan’s benefits, including its provider network, to the cancer care needs you have identified, hopefully with help from the NCCS webinar and online videos and other resources.

If you are enrolled in an ACA Marketplace plan and are satisfied with that plan, you should still review the plan’s benefits in case they have changed and/or in case your cancer care needs have changed.

Interview – What to Consider When Choosing an ACA Marketplace Plan

In this conversation, Mila Kofman, the executive director of the DC Health Benefit Exchange Authority, discusses the intricacies of health insurance marketplaces, particularly for cancer survivors. She explains how to navigate the open enrollment process, the importance of understanding different health plans, and the role of insurance navigators and brokers. Kofman emphasizes the need for consumers to be proactive in checking their coverage options, understanding their financial situations, and ensuring they have access to necessary medical providers. The discussion also highlights the importance of maximizing available assistance and benefits, especially for those with specific health needs.

Video Chapters

- 00:00 Understanding Health Insurance Marketplaces

- 02:37 Choosing the Right Plan for a Cancer Survivor

- 05:30 How Can Insurance Navigators Help?

- 07:00 Navigators vs. Brokers: Understanding the Differences

- 10:06 Open Enrollment: What You Need to Know

- 12:00 How to Maximize Assistance and Premium Savings

- 14:30 Network Adequacy – Are Your Doctors In-Network?

- 17:12 Tips for Choosing the Best Health Plans

Navigators vs. Brokers: What is the Difference?

The big difference between insurance brokers and navigators is that insurance brokers tend to get paid through commissions from insurance companies and navigators or assisters get grants from state-based marketplaces or the federal marketplace to provide consumers with assistance. In both cases, the help itself is free.

Employer-Based Health Plans

When is Open Enrollment for Employer-Based Plans?

Enrollment options are defined by your employer. If your employer offers health insurance options, the employer will inform you of the deadlines for making your enrollment choice. Your employer will also be able to identify the means to access materials about insurance options.

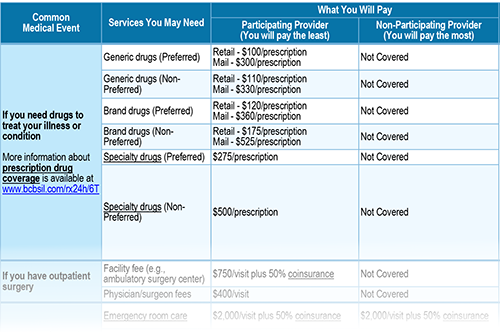

Whether you are generally satisfied with your current insurance plan or know that you need to evaluate other options because of your own changing cancer care needs, you should evaluate the Summary of Benefits and Coverage (SBC), which provides a snapshot of an insurance plan’s benefits, as well as the more detailed plan documents. You can evaluate whether the doctors you rely on are in-network for insurance plans and whether and how your prescription drugs are covered and reimbursed.

Interview – What to Consider When Choosing an Employer-Based Insurance Plan

In this conversation, Kaye Pestaina, Vice President of KFF and Director of the Program on Patient and Consumer Protection, discusses the complexities of choosing health plans for cancer patients and survivors. She explains the differences between HMO and PPO plans, the structure of costs, including premiums and deductibles, and the importance of preventive screenings. She also covers the challenges of navigating provider networks, the impact of prior authorization on treatment, and available resources for patients. Finally, she emphasizes the need for vigilance and seeking help when selecting health plans to ensure access to necessary care.

Video Chapters

- 00:00 Understanding Health Plans: HMO vs PPO

- 01:40 Understanding Premiums, Deductibles, and Out-of-Pocket Maximums

- 03:30 What Preventive Screenings are Available at No Cost?

- 04:50 Provider Networks: Importance for Cancer Patients

- 09:22 Prior Authorization: Challenges and Solutions

- 13:10 Resources for Plan Comparison and Selection

- 16:51 Ensuring You’re Informed On Changes in Health Plans

- 20:06 Final Advice for Cancer Survivors Choosing Health Plans

Understanding Deductibles

A type of plan called a high-deductible health plan will have low premiums, but very high deductible payments. And the deductible is really the amount you have to pay before your health insurance kicks in. If it’s really high, and it’s only getting higher these days, in the thousands of dollars, you’re going to have to pay that in addition to your monthly premium before you can access care at whatever cost sharing there is.

Federal Employee Health Benefits (FEHB)

When is Open Season for Federal Employee Health Benefits?

November 11 to December 9, 2024

The FEHB Open Season webpage provides instructions on understanding any changes in your current plan and advice about what to do to retain your current coverage or to assess other options for 2025. See online resources: https://www.opm.gov/healthcare-insurance/open-season/active-federal-employees/.

Please note the advice to look at the plan brochures for health plans, dental plans, and vision plans. The webpage also includes links to OPM Plan Comparison Tools and other tools for comparing health plans.

Interview – What to Consider When Choosing an FEHB Plan

In this conversation, Jay Fritz, a program manager for the Office of Personnel Management, discusses the various health insurance options available to federal employees, particularly focusing on cancer patients and survivors. He explains the range of plans, the importance of understanding benefits, and the resources available for comparing plans. He also covers the annual Open Season for plan selection.

Video Chapters

- 00:00 Overview of Federal Employee Health Benefits Plans

- 02:03 Navigating Plan Options and Resources

- 03:37 Understanding Prescription Drug Coverage

- 05:08 Ensuring Your Care Team Is In-Network

- 06:35 Using Resources for Navigating Plan Details

- 07:51 Open Season Details

- 10:36 Advice for Cancer Survivors

More Resources

See an example of a SBC. In this example plan, the deductible is low but the co-pays are very high.

What is a Summary of Benefits and Coverage (SBC)?

The Summary of Benefits and Coverage (SBC) document is a standardized summary of covered benefits and cost sharing. It is a key information tool that helps consumers compare health plan options on an apples-to-apples basis. It summarizes how plans cover (or exclude) all major categories of benefits, as well as cost sharing (in-network and out-of-network, if applicable) for all benefit categories. Federal law requires all private health insurance plans to offer, post prominently, and provide the SBC upon demand.

See an example of a SBC here. This example plan has a low deductible, but very high co-pays.

The SBC can sometimes be hard to find. For help finding SBCs on Healthcare.Gov, check out this PDF.

MyHealthcareFinances

MyHealthcareFinances is a tool to help you better understand finances related to health care and steps you may take to lower your costs. Their goal is to provide an overview of key topics that may be helpful to you and point you in the right direction on where to find more information.

MyHealthcareFinances is a tool to help you better understand finances related to health care and steps you may take to lower your costs. Their goal is to provide an overview of key topics that may be helpful to you and point you in the right direction on where to find more information.